DataLend’s Exciting New User Platform and Enhanced Real-Time Data

By Rebecca Branca & Keith Min, Data Specialists, Data & Analytics

October 17, 2024

With diverse businesses and roles within the securities lending marketplace, all having unique data requirements, users need access to customizable and dynamic tools that cater to their needs. On September 9th, the EquiLend Data & Analytics team launched a new platform focused on delivering just that — personalized user experiences, simplified research capabilities, and a real-time data flow that brings more precision and efficiency to decision-making. Here’s a breakdown of the most impactful changes:

Dashboard: Tailor-made for You

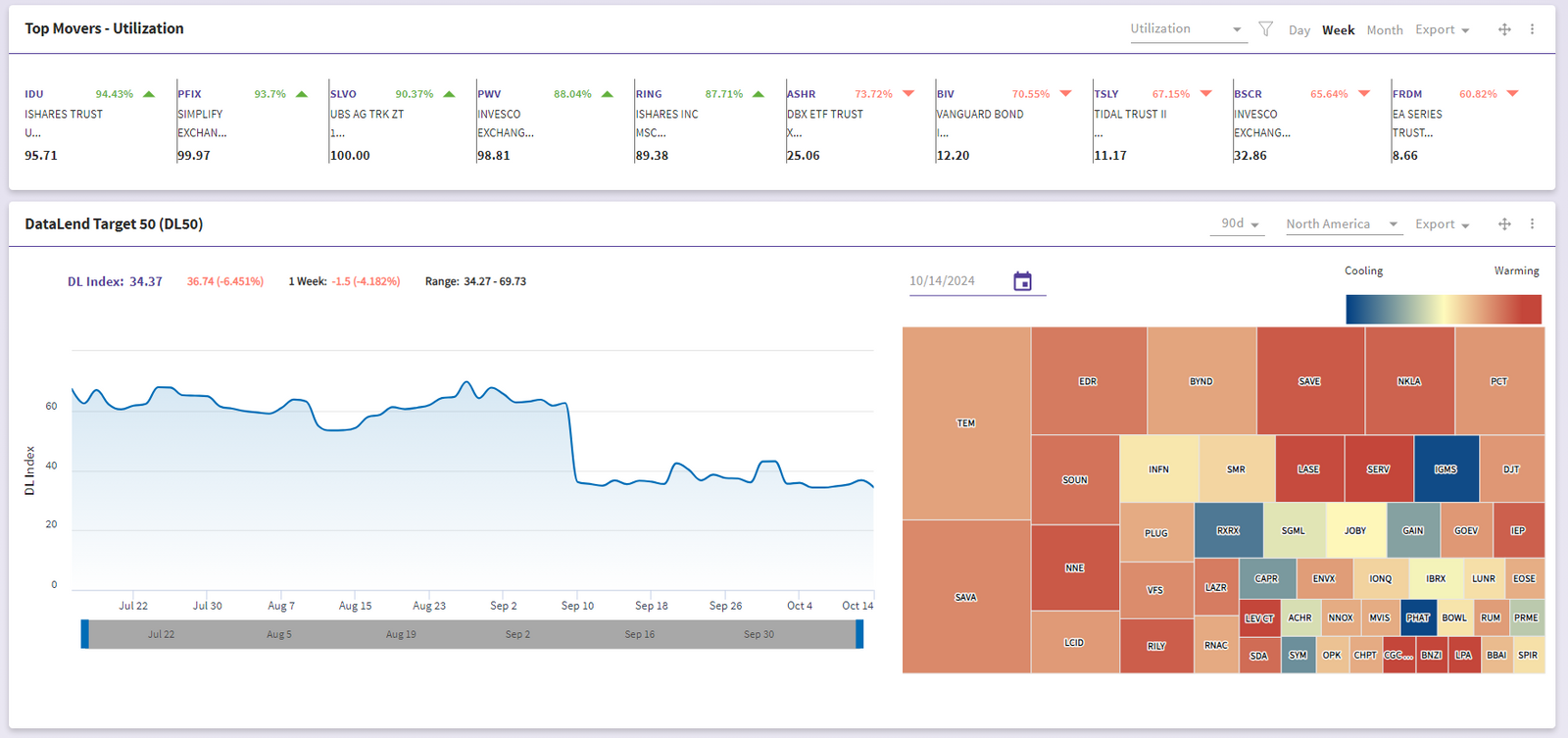

The updated home page allows each user to design multiple dashboards that reflect their unique needs. Rather than being constrained by a one-size-fits-all layout, users can now adjust views to focus on what’s most important to them.

For traders, this might mean focusing more on market movers, newly hot stocks and the DataLend50 (DataLend’s proprietary index tracking the 50 most expensive names) heatmap rather than using screen real estate on a foreign market’s utilization rates. Those interested in benchmarking can holistically view their aggregated data next to the industry data across multiple markets and asset classes in the same graph over a two-year time frame. This flexibility ensures that each user’s dashboard displays exactly what they need, without distractions.

Security Search: Expanded Metrics and Flexibility

The enhanced Security Search tab begins with a data ribbon now offering the full array of DataLend metrics at the top of the screen. Want to compare a corporate bond or a preferred share with its common stock? The enhanced “Other Issues” feature makes this comparison easier than ever by comparing all securities from the same issuer. Additionally, corporate action notifications have expanded. Tender offers, takeovers, share repurchases, and others now join dividends and stock splits to provide more insight into a security.

On the visual side of Security Search, users have full customizability on the positioning and size of each widget. Improved graphing tools allow users to chart any data points together, analyze Price vs. Utilization or On Loan Quantity and Rebates or Fees vs. The Short Interest Indicator, all comparison previously unavailable to users.

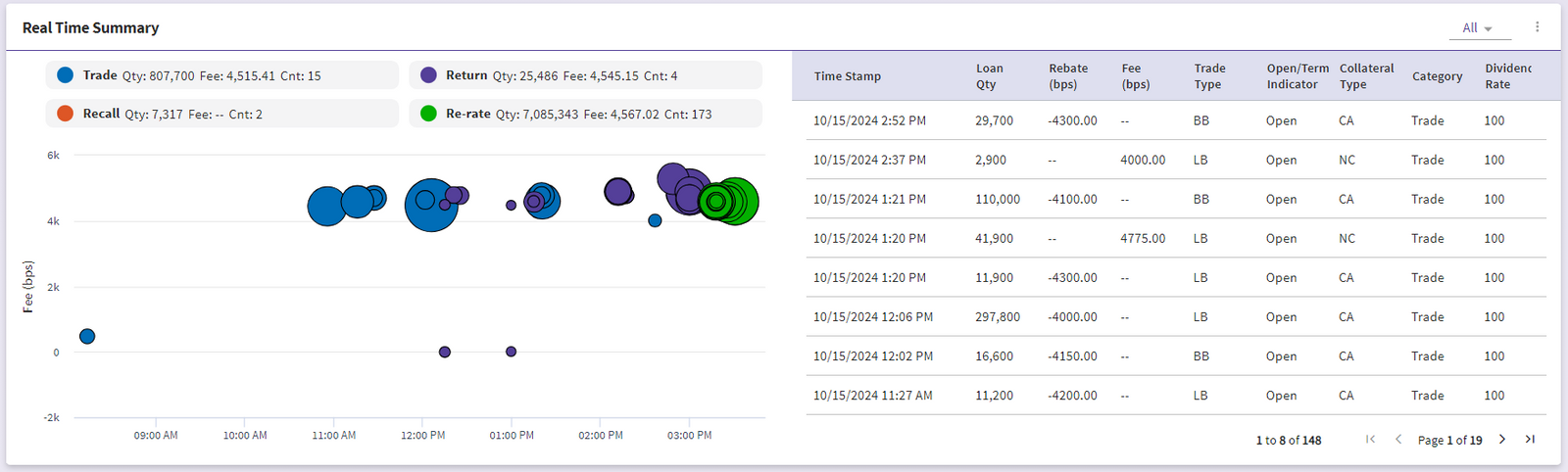

Real-Time Data: All Life Cycle Events for All Markets

EquiLend’s Real-Time data product has received a major upgrade. Now, users can monitor returns, rerates, and recalls with the global coverage and accuracy they’ve come to expect from DataLend. Moreover, the new market distinction feature allows for comparisons across average rates and industry totals not just for the lender-to-broker market, but also broker-to-broker, and a combined view of the entire industry.

The introduction of a new chart displaying full front-to-back intraday activity in Security Search ensures users can visually grasp intraday trends in an instant.

Research: One Report When You Need it the Most

Gone are the days when users had to create multiple reports to see industry deltas and “my vs the industry” data. Now, any data point in Research can be included in a single, consolidated report. Whether a user is utilizing the new Broker-to-Broker fee buckets (1, 5, 10, etc.), day-over-day active utilization changes, or my vs the industry fields, everything can be incorporated into a single report.

Scheduled reports will also arrive up to three hours earlier, reaching inboxes by 5AM EDT, giving users more time to process and plan target securities. Sharing reports with colleagues has also been simplified. In addition to filters, the exact columns and sorting preferences are shared, ensuring that the whole team is operating with the same perspective.

The new DataLend UI was designed with flexibility, customization, and collaboration in mind. With enhanced dashboards, expanded research capabilities, and real-time data updates, users are better equipped to tailor their experience to what matters most. Whether the user is in trading, operations, or in relationship management, the new UI will empower the user to stay ahead in today’s securities lending market.