Cash Reinvest Analysis Reflecting on the Federal Reserve Rate Cut September 2024

By David Poulton, Data Specialist, Data & Analytics

October 17, 2024

September 19th, 2024, marked the first time the Federal Reserve cut interest rates since March 2020. They set the new target rate between 4.75% and 5.00%, a reduction of 50 bps from the previous level of 5.25% to 5.50%. Having previously analyzed the behavior of any trends associated with such rate changes, the team at EquiLend Data & Analytics have taken a fresh look back over the last five years.

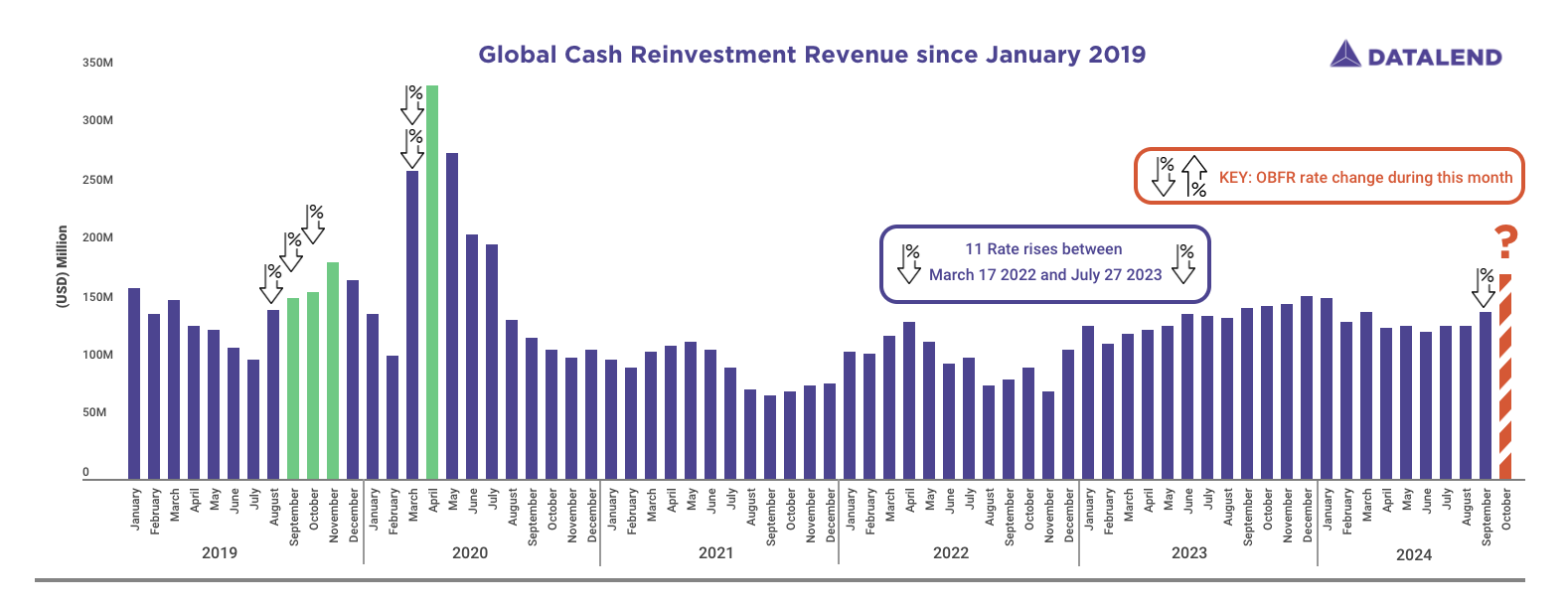

Approximately 90% of all cash collateral received in the securities lending market is in US Dollars which means that rate changes in the US can have a significant impact on revenue earned from cash reinvestment as shown in the chart above.

When cash is provided as collateral against lent securities, the borrower receives a rebate rate on this cash. The rebate is typically quoted in reference to a benchmark rate, which for US Dollars the industry widely accepts the Overnight Bank Funding Rate (OBFR). The more in demand a security is, the lower the rebate rate. Agents will reinvest the cash collateral received into reverse repurchase transactions or short-term money market instruments. The yield on the investment minus the rebate paid results in the return on the loan.

The loan leg of the transaction is typically overnight whereas cash collateral can be invested in a mix of instruments with varying maturity dates allowing for some duration mismatch between the loan and the cash re-investment legs. As a result of this, spreads tend to widen when rates are cut, as the rebate rate resets immediately while the yield on the cash reinvestment fund continues to benefit from longer dated investments and tighten when rates rise.

The corresponding impact on cash re-investment revenue can be seen in the chart above. The bars on the chart highlighted in green show an increase in cash reinvestment revenue in the month after a rate cut, the largest increase in April 2020 followed two separate rate cuts announced in March 2020. There were eleven rate increases between March 2022 and July 2023 which led to a mixed bag of results. November of 2022 saw one of the worst months of reinvestment returns following back-to-back 75 bps rate hikes. With the first rate cut in four years, it is anticipated that October will see an increase in reinvestment revenue as investors take advantage of the duration mismatch. The team here will continue to monitor how this plays out for real.

Federal Funds rate changes sourced from: https://www.federalreserve.gov/monetarypolicy/openmarket.htm.