DataLend

Global Securities

Finance Data

DataLend provides aggregated, anonymized, cleansed and standardized securities finance data covering all asset classes, regions and markets globally.

DataLend Advantage

Data available T+1

Rigorous data cleansing process

Leverages EquiLend & BondLend trading data

Proprietary indices, including DataLend Target 50 and DataLend Newly Hot

Options-derived implied borrow cost

Daily newsletters and automated reports

Frequent thought leadership contributor to RMA, ISLA, PASLA, CASLA, IMN and other securities lending associations as well as various industry magazines

As of February 2026

Best Market Data Provider Globally

DataLend Offers Four Ways to Access:

Raw data files that contain fees, utilization and other metrics across all securities on loan

An intuitive and highly customizable Web-based user interface

An Excel Add-In tool that supports functions and right-click functionality

An Application Protocol Interface (API) that allows clients to access data directly from the database

Client Confidentiality

DATALEND MAINTAINS THE HIGHEST DATA SECURITY STANDARDS TO PROTECT CLIENT DATA AND IDENTITY:

Internet Protocol (IP) Security: All User IDs are tied to an approved organization IP address meaning a user cannot log-in from outside their corporate network.

Beneficial Owner Confidentiality: Each agent lender assigns a code to their underlying beneficial owner client. DataLend does not know the identity of any beneficial owner.

Segregation: Each client organization within DataLend is strictly segregated from other organization in our secure database tables. User IDs are tied directly to an organization.

Introducing EquiLend Spire

Trading

- All

- Trading

- CPR

- Research

Trading

The Security Search screen is a highly customizable, intuitive view into securities lending activity taking place within a specific security. The tool contains current and historical data, including volume-weighted average fees, utilization, on-loan and inventory balances, short interest, re-rate information, transaction-level data, corporate actions and other information critical to securities lending trading performance.

CPR

The Security Search screen is a highly customizable, intuitive view into securities lending activity taking place within a specific security. The tool contains current and historical data, including volume-weighted average fees, utilization, on-loan and inventory balances, short interest, re-rate information, transaction-level data, corporate actions and other information critical to securities lending trading performance.

Research

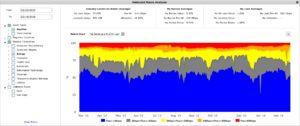

The Research screens allow traders and analysts to assess their portfolio performance relative to the industry either at an aggregate level or drilled down to the asset class, sector or individual security level. The screens also allow users to identify market movers with predetermined fee or utilization changes. Reports may be customized and emailed on a daily, weekly or monthly basis.

Best Market Data Provider Globally

Global Investor/ISF Awards 2013, 2014, 2015, 2016,

2017, 2018, 2019, 2020, 2021, 2022