DataLend Client Performance Reporting

Experience robust performance reports with unparalleled insight into your securities lending program. Benefit from standardized performance measurement, flexible but DataLend-controlled peer groups and unique and exclusive data. Optimize your lending program and maximize revenue by making the most informed decisions with DataLend’s CPR.

Standardized Peer Groups

Ensure consistency across performance reviews through the use of DataLend’s standardized peer groups. DataLend’s peer groups are controlled by the DataLend proprietary algorithm. They cannot be manipulated to impact performance.

Four peer group matching options allow users to select the best peer group match (in addition to matching at the security and dividend rate by default):

Industry (most relaxed criteria)

Legal structure and collateral type

Legal structure and fiscal location

Legal structure, fiscal location and collateral type (strictest criteria)

New! DataLend Collateral Matching

Exclusive Data

DataLend has access to inventory and loan positions not included in any other securities lending data service. Ensure this data is part of your analysis to obtain the most accurate performance measurement possible.

Flexibility

ACCOUNT DRILLDOWN

REVIEW PERFORMANCE ACROSS ALL ACCOUNTS

- Identify Which Accounts Are Under Or Over-Performing Versus The Group

- Navigate To A Selected Account For Further Analysis

CREATE-YOUR-OWN PERFORMANCE METRICS

Multi-select by asset class, country and sector over a customized time period and tailored account groups.

Portfolio Summary

Use the filter options to choose your peer group, timeframe and asset class to see how your portfolio is performing on a relative basis.

Performance Metrics

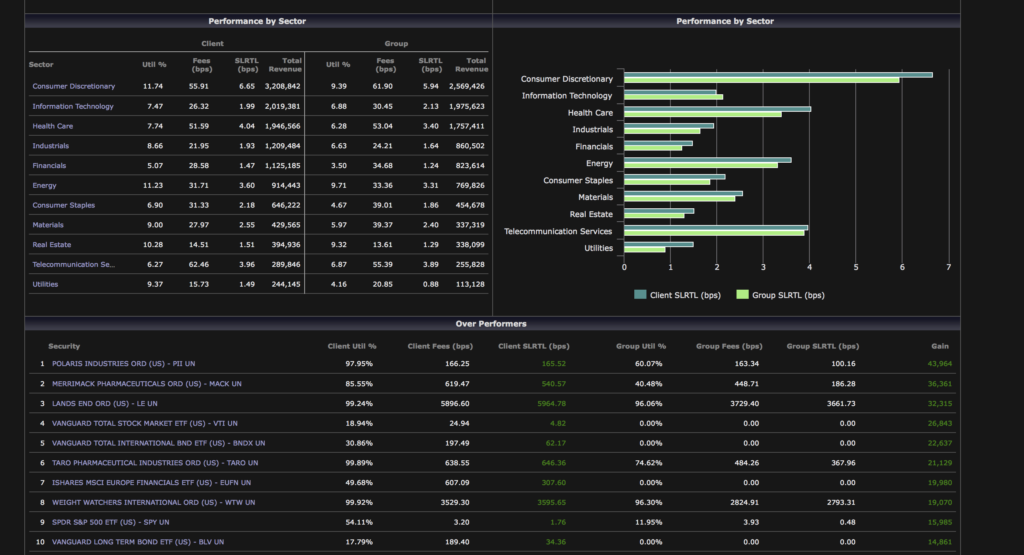

Once your filters are applied, a wide variety of performance metrics will appear. Examples include performance by sector and over performers, pictured here

Best Market Data Provider Globally

Global Investor/ISF Awards 2013, 2014, 2015, 2016,

2017, 2018, 2019, 2020, 2021, 2022