Will IPOs Return as a Feature of the Stock Lending Playbook?

A sleepy IPO market is beginning to stir; DataLend looks at the impacts of IPOs in securities lending

Alec Rhodes, Product Specialist, EquiLend Data & Analytics

October 23, 2023

IPO Lending: Supply and Demand

The mechanics of IPOs create dynamic market conditions for both lenders and borrowers. On one side of the equation is volatility.

Investment bankers acting as the underwriters of the IPO as well as third-party analysts spend countless hours on firm valuation in an attempt to set an accurate target price for shares. However, share price gains and losses in the initial days of trading are often highly volatile. Naturally, this presents short-sellers with an opportunity to capitalize on fast-changing momentum.

On the other side is lending supply. With the U.S. equity market clearing and settling trades on a T+2 basis (soon to move to T+1), there is a two-day lag for the results of a trade to fully propagate to the books and records of broker-dealers. While normally, overall market liquidity can help offset this operational reality, borrowers must navigate an additional layer of complexity when trying to locate available lending supply of newly trading stocks.

Insider share lock-ups present an additional complication by way of reducing the free float of the IPO security.

Company insiders, usually employees, are often prohibited from moving their shares for a specified period of time following the IPO. This is done to prevent a drastic sell-off but can also significantly reduce lendable inventory during this period.

New Names Ring the Bell

With interest rates and the equity market (seemingly) stabilizing, the second half of 2023 has seen the beginnings of an IPO rebound.

Recently, a one-week period in September saw three marquee offerings; Semiconductor producer Arm Holdings PLC (ARM) debuted on the NASDAQ while delivery service Instacart (Maplebear Inc., CART) and marketing technology firm Klaviyo Inc. (KVYO) were listed on the New York Stock Exchange.

Arm stock began trading on Friday September 15 and closed its first day at $60.75, up 19.12% from its initial price of $51.00. Its quick gains receded and at the time of writing, shares were trading at $53.52. From a securities lending perspective, DataLend first published available inventory for Monday September 18, with 11.8 million shares available. This number steadily climbed to 37.7 million lendable shares as of September 26. Lenders who were able to make ARM inventory available quickly were able to reap higher fees; The security started off trading special on September 18, but has since seen a 78% decrease in fees.

ARM Share Price vs. Loan Quantity

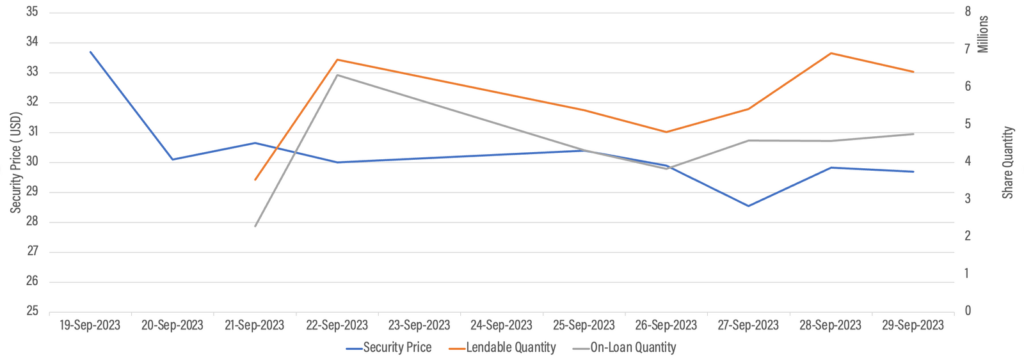

Instacart executed its much-anticipated IPO on Friday September 19, with shares closing down roughly 20% at $33.70. The stock edged lower over its first week on the market and closed the month of September at $29.69. Like with ARM, available inventory was in-demand with utilization increasing in concert with lendable shares. Over the observed period, the lendable quantity increased from 3.5 to 6.4 million shares. On-loan followed, increasing from 2.3 to 4.8 million shares. From a cost perspective, CART also opened as a hard-to-borrow, with shares commanding significant fees. As more supply has become available, borrow-cost has receded significantly, but the stock is still commanding fees well above 1,000 basis points.

CART Share Price vs. Loan Quantity

Klaviyo largely followed the same pattern as Arm and Instacart in its early days. Inventory has increased from 5.7 to 12.1 million shares while open loans have increased from 3.6 to 6.7 million shares. Cost-to-borrow also stuck firmly in the hard-to-borrow range albeit with a 21% easing of fees over the first week of lending activity.

KVYO Share Price vs. Loan Quantity

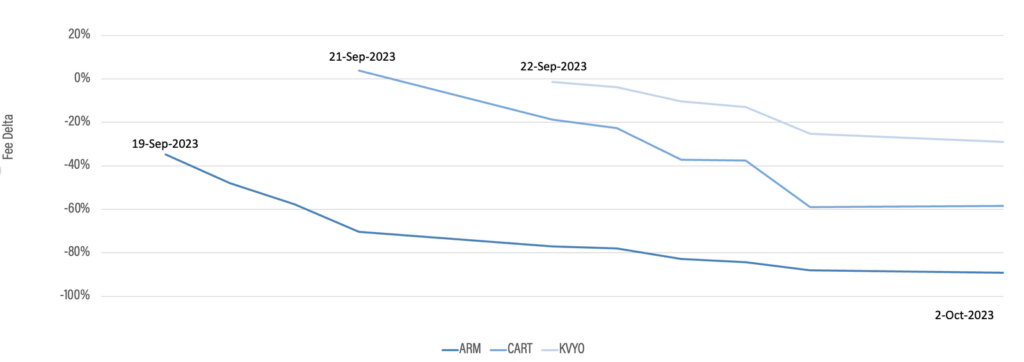

Looking at fee data across all three securities, cost-to-borrow was initially high before cooling significantly in the weeks following the IPO. The following chart tracks the percentage change in new loan fees from the initial trade date to the current date (as of October 2).

DELTA: Current vs. Initial Fee

The supply dynamics of new names within the lending market and the subsequent impact on cost-to-borrow underscore the utility of timely market data. Based on this recent history, DataLend will look for IPO names to continue to be prevalent in the securities lending market through the rest of 2023 and beyond.

About DataLend

DataLend, the market data service within EquiLend’s Data & Analytics Solutions group, tracks daily market movements across more than 62,000 unique securities in the $2.5 trillion securities finance market. www.datalend.com

About EquiLend

EquiLend is a global financial technology firm offering Trading, Post-Trade, Data & Analytics, RegTech and Platform Solutions for the securities finance industry. EquiLend has offices in North America, EMEA and Asia-Pacific and is regulated in jurisdictions around the globe. The company is Great Place to Work Certified™ in the U.S., UK, Ireland and India and was named Best Post-Trade Service Provider Globally, Best Market Data Provider Globally and awarded for its Diversity & Inclusion in the Securities Finance Times Industry Excellence Awards 2023. www.equilend.com