ROUNDTABLE: HOW BENEFICIAL OWNERS USE MARKET DATA

BILL FOLEY

Director, SecFinHub

JOSH GALPER

Managing Principal, Finadium

SARAH NICHOLSON

Consultant, Consolo Ltd

BILL PRIDMORE

President, William F. Pridmore Ltd.

September 26, 2017

Consultants specializing in working with firms to optimize their lending programs discuss how their beneficial owner clients are making the most of securities finance market data

In your experience, how do most beneficial owners consume securities lending data—reports from their agents, direct access to a data provider, in-house proprietary data? What metrics do they look for and why?

Bill Foley:

Historically, the majority of beneficial owners took the securities lending data provided by their agent lender, with only the largest participants having a direct relationship with the data providers. While this is still the case, I see the picture changing somewhat.

The beneficial owners are asking more questions about the data, drilling down to a much more detailed level than was perhaps the case previously. This has led some participants to take data directly as they look to interpret the information independent of their agent lenders. However, regardless of the chosen route, there is a far greater understanding of how the data is compiled and what the data means—and this is the critical point. The information available must be relevant and understood fully to ensure that it allows beneficial owners to make informed decisions, understand their program performance and meaningful peer comparison within the context of the wider market and the direction of travel.

In terms of the metrics that beneficial owners focus on, these vary on a case-by-case basis and will relate to the overall aims of the lending program. Obviously, revenue/fees generated is the focus, but, again, there needs to be context. Some are focused on ensuring that revenue on each transaction is at least in line with the market; others look to gauge how their service providers are performing overall. Increasingly, however, beneficial owners are using data to understand how their chosen program parameters are delivering performance against their peers. This can be a powerful tool when looking to loosen or tighten certain aspects of their lending activity.

JOSH GALPER:

We see a bifurcation in the market where numerically, most beneficial owners get their securities lending data from agent lenders, but there is a leading group that gets data directly for their own analyses. The group that receives data from agents is primarily concerned with verifying some level of best execution. The group with their own data are tracking opportunities in the market, feeding back securities lending information to portfolio management teams, and of course monitoring for best execution. A very small group of beneficial owners is using multiple agent lenders and tracking best execution by comparing their internal results of concurrent loans in the market.

SARAH NICHOLSON:

In my experience, beneficial owners fall into two clear categories: the complex, engaged beneficial owner, who will have sourced data directly and will be proactively reviewing various aspects of their data, and the less complex or engaged, who will see data provided by their agent lender as part of the regular review process. I often get asked, “How can I trust the data my agent lender provides?”—frequently from beneficial owners who use more than one agent lender and get conflicting information. I always suggest direct access to the source, but often this is perceived to be prohibitively expensive or complex to achieve, although this is not necessarily the case.

BILL PRIDMORE:

Most beneficial owners get virtually all their securities lending data from their agent directly. Few have the resources or time to utilize direct access or build a proprietary system to manipulate lending data. As for the metrics, the most sophisticated beneficial owners are always looking to make sure they can demonstrate to their stakeholders that the agent is doing a good job. This means forming some type of performance comparison that demonstrates their lending performance is within the bounds of other similar market participants.

Do you have any anecdotes or examples of how beneficial owners have benefitted from securities lending market data?

FOLEY:

I think there are probably too many to mention! Not all of them will be seismic in impact, but I can think of many examples where data has had a positive impact on a beneficial owner’s lending activity. Of course, many are examples where revenue has been enhanced, but there are many others where aspects of the lending program have been changed for the better as a result of data highlighting areas for improvement.

GALPER:

There are two examples that stand out in beneficial owner use of securities lending data. The first is using data to engage in proactive conversations with agent lenders. Whether initiated by the agent or the lending client, the ability to look at the same data independently facilitates the discussion about the trade opportunity and where it is going. The second is integrating securities lending data with portfolio decision-making; this is the next level of advancement in securities lending data management.

NICHOLSON:

I have used data in my consultancy work to back up the commercials of strategic change, both in respect of volumes and service provider change. It is most often an act of enlightenment when a beneficial owner is able to see peer group performance analysis and understand how their risk appetite and returns in lending are so intrinsically linked, as well as how all agent lenders are not equal!

PRIDMORE:

You can really learn some surprising things when you look at the data. For one client with a fairly large program at a custodian, we discovered that roughly 80% of their income was being generated by specials, but 80% of their loan volume (and the associated cash collateral reinvestment risk) was producing only 20% of their income. We were able to work with the custodian to modify their lending guidelines to focus on the high-margin loans and discourage low-margin, high-volume lending.

In another situation, I was able to use market data to change a beneficial owner’s negative view of lending. In that case, they had stopped lending because of the view that it was not worth the potential risks. I was able to demonstrate, using market data, that if they lent a handful of their positions they could generate an attractive incremental basis point return for the entire portfolio with minimum risk.

How important is market data to beneficial owners’ securities lending programs?

FOLEY:

As outlined above, if the data is relevant, fully understood and applied in the correct context, I think it is an extremely effective tool to help beneficial owners shape and manage their programs as well as informing their discussions with service providers.

GALPER:

Every firm needs data for at least a static report to show best execution, but this could be a quick review, then reports are filed away on a quarterly basis. The historical practice has been a casual review, but best execution monitoring is growing in importance with regulations like MiFID II. For beneficial owners actively engaged in their lending programs, data is critical. In an ideal world, all beneficial owners would be actively engaged with strong fiduciary oversight and conduct an annual review on their agents and trading practices using good data, but this does not always happen in practice.

NICHOLSON:

I think this depends on their level of engagement. I know, for some, data drives all decisions and is proactively utilized. However, recognizing that participation in securities borrowing and lending isn’t a core focus of any fund strategy, for many [beneficial owners] revenues are still a “nice to have,” and they are not able to provide the focus on data that they could. Whilst it is undeniable that proactive management of lending activity using market data can improve virtually any beneficial owner’s returns and without significant additional risk, it may not always be sufficient to warrant the prioritization of this.

PRIDMORE:

I advise clients that market data can be used as a good check on the performance of their lending agent. For many, it is the only source of information that is independent of their agent, and an analysis of that data can lead to important conversations on performance with their agents. Performance market data may not be the only consideration in retaining a lending agent, but it is an important part.

Do beneficial owners make program decisions based on securities lending data, or do they leave that to their agents?

FOLEY:

They certainly do. Securities lending data plays an increasingly important role in progressing (or not) a proposal and building a business case/justification. This is another reason why we see an increased demand for direct access to data providers and independent analysis.

GALPER:

Getting back to the idea of market bifurcation, most beneficial owners leave daily decision making to their agents. A small group has taken a different, more profitable approach, and is using the data themselves to create or respond to trading ideas in cooperation with their agents.

NICHOLSON:

Decisions fall into many buckets, whether it is a risk management/mitigation decision, a regulatory one or a commercial one, and clearly the drivers behind them will vary significantly. Focusing on the commercial decisions, these are most often taken in reaction to market demands or agent lender proposals.The appointment of an agent lender means that the beneficial owner, by definition, may not be close enough to the day-to-day market to identify opportunity and will rely on the agent lender. Or, they may be notified through existing relationships with the large borrowers. But either way, data is increasingly used to assess or evidence the impact of potential decisions. Risk decisions may be taken more independently or in reaction to events in the market, but again, increasingly beneficial owners want to understand the impact and will look to data to explain it.

PRIDMORE:

Most beneficial owners have some sort of fiduciary responsibility to evaluate the performance of their lending activity. They can’t rely solely on their agents’ assurances. So they do use market data to evaluate their agent’s performance on a periodic basis. This can take the form of a regular quarterly or annual performance review, or to help evaluate the veracity of projected income.

How actively do beneficial owners review securities lending market data—on a trade-by-trade basis, at quarter-end or somewhere in between?

FOLEY:

All the above! I have worked with clients who review all lending transactions daily and others who use the data to review their overall performance over a longer period. It really depends upon what is appropriate for that client, what their program focus is and what benefit they will derive from their approach—there is no right or wrong answer. However, as discussed earlier, the trend is toward greater and more detailed analysis, and this of course means more frequent, and, importantly, ongoing analysis of your lending business and your provider’s performance.

GALPER:

It’s a wide range, with some beneficial owners looking at data several times a week and others looking closely only once a year. This is part of the transitioning mindset away from securities lending as a “set it and forget it” activity and towards securities lending as a core part of the investment process.

NICHOLSON:

I think most commonly formal reviews would be on a quarterly basis as part of their risk or credit committee structure. The data will be used to compare utilization and revenue levels, as well as for market and credit risk management. More robust analysis may be undertaken as part of a review or business planning process.

PRIDMORE:

For the most part, beneficial owners don’t have the time or inclination to second-guess their lending agent on individual loan decisions. I advise clients to look at the data on a quarterly or semi-annual basis. For some, it is important to understand the outliers, knowing what loans generate the most income and were those loans competitively priced.

NANCY ALLEN

Global Product Owner, DataLend

DataLend sees firsthand the ways in which beneficial owners use data to manage their securities lending programs. We echo the sentiment of our expert panelists, who noted the wide spectrum of approaches that different types of beneficial owners take in using data.

Indeed, some beneficial owners rely solely on their agents for basic quarterly or annual reports outlining earnings and balances. These clients tend to be satisfied with a review of year-over-year performance, perhaps with some industry color provided by the agent to explain changes in revenue, fees and balances.

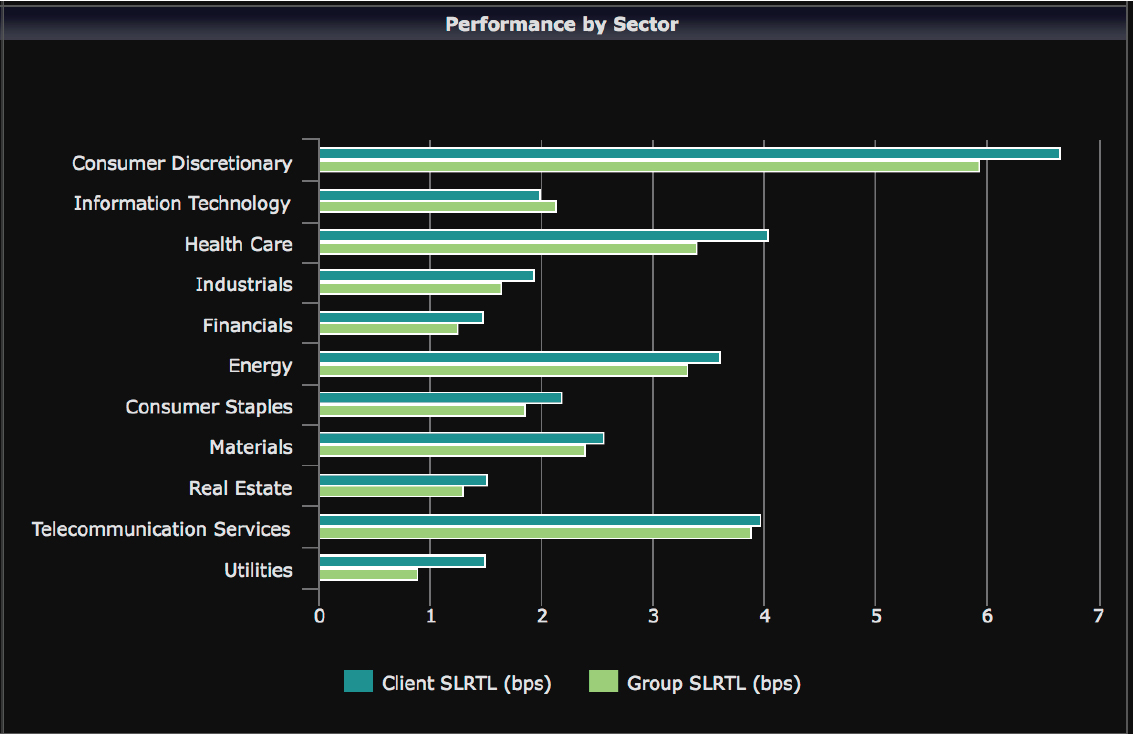

Other clients take a more direct approach by utilizing our performance measurement tool, DataLend Portfolio, to obtain an aggregated view of their program across multiple agents and to perform industry and peer group analysis weighted to their portfolio holdings. This group tends to be more interested in revenue attribution and is looking to quantify returns relative to risk. The peer group analysis not only measures portfolio performance relative to a like peer group, but it also helps the beneficial owner understand their revenue attribution relative to that of the market.

For example, using DataLend Portfolio, the beneficial owner can identify its top-earning sector as well as understand the drivers of performance (such as fees, utilization, cash reinvestment or others) all relative to the peer group. Cash versus non-cash and term versus open balances are tracked, as well as top performing and underperforming securities and missed opportunities.

Finally, there is another group of beneficial owners who subscribe to DataLend’s daily, security-level data feeds. Clients using the data feed conduct their own analytics to identify market trends and opportunities, and, in some cases, will incorporate securities lending data into their portfolio management strategies.

Whether beneficial owners take a light or an intensive approach to their consumption and analysis of securities lending data, the data facilitates more fruitful conversations with agents and assists beneficial owners in making optimal and informed decisions regarding their lending programs.