As Covid Unfolds, These Securities Heat Up

David Poulton & Keith Min, DataLend Product Specialists

October 2020

SEVERAL OF THE top-earning stocks in the securities lending market this year made their way to the list due to some impact of the COVID-19 pandemic. Among the top five are Carnival Corp, which faced a $3 billion loss in the third quarter following a months-long No Sail Order, and Inovio Pharmaceuticals, which faced ups and downs as the company strove to develop a coronavirus vaccine.

Throughout the COVID pandemic, a number of industries have been roiled, from pharma, which is working to develop a vaccine, to transportation, which flatlined as the world went into lockdown. Even the communications industry was hit in certain areas; the dating app market, for example, was negatively impacted as social distancing rules and general apprehension precluded socializing as we know it. DataLend analyzed key sectors and securities impacted by the coronavirus pandemic in this look-back over the first three quarters of 2020—from the calm before the storm through to today.

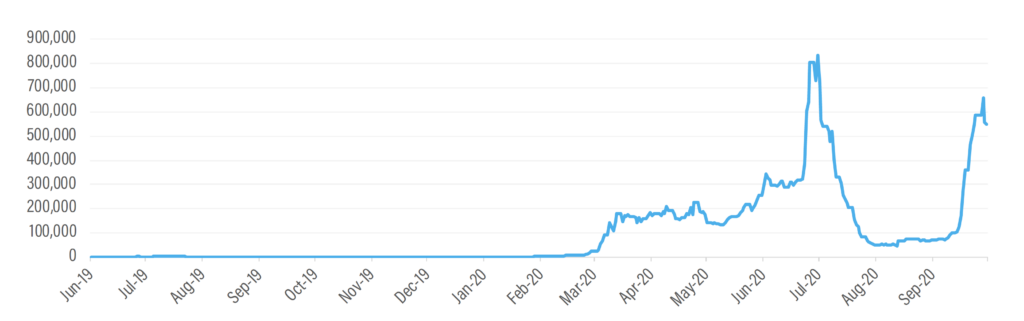

One of the top-earning “COVID securities” in 2020 is INOVIO PHARMACEUTICALS INC (INO), which experienced a “biotechnology rollercoaster ride” as world events and news related to the firm’s potential coronavirus vaccine unfolded. The daily revenue generated in the securities lending market by this security closely mapped the global ebbs and flows of COVID cases, with numbers rising to a peak in July before dropping off over the summer months, followed by a second wave more recently.

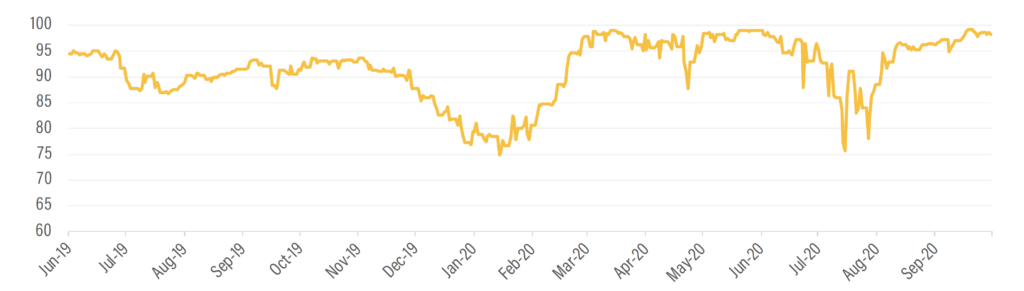

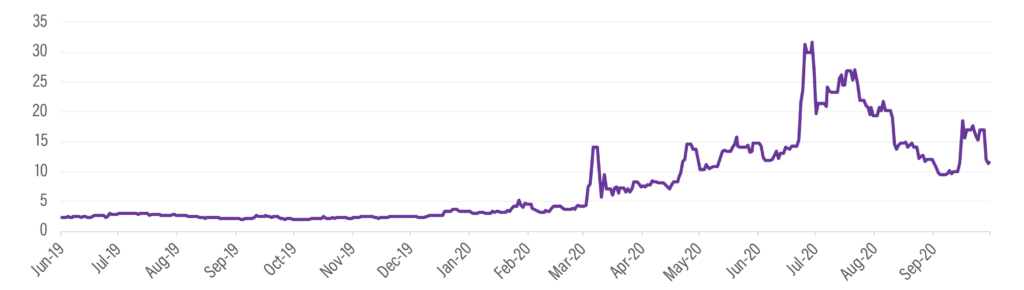

INO utilization fluctuated between 77% and 99% from March through September as the firm revealed a series of updates regarding its Phase 1 trial of a candidate vaccine. On-loan and total lendable balances grew over the same period as securities lenders turned their attention to this security. The security price peaked at $31.69 in July before dropping off more recently as anticipation of Phase 2-3 trials was muted following a “partial clinical hold” placed by the U.S. Food and Drug Administration (FDA) in September. Through the end of Q3 this year, INO has generated more than $47 million in revenue for lenders. For more information on INO, see Figures 1, 2 and 3.

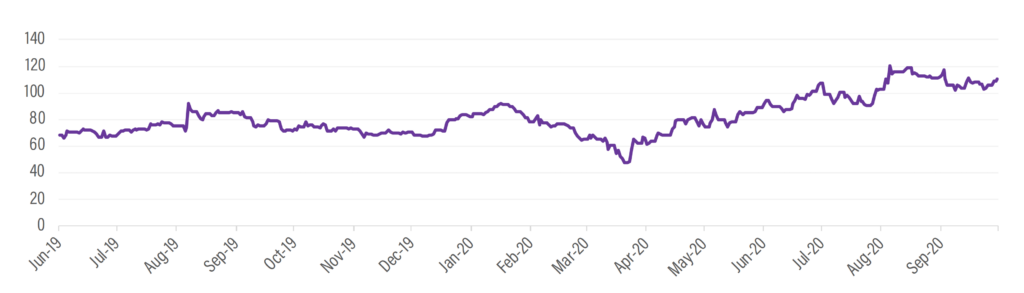

In the Communications/Interactive Media sector, the #1 revenue earner over the first three quarters of 2020, with $123.9 million in lending revenue, was MATCH GROUP INC (MTCH), as depicted in Figure 4. Stock in the online dating company, which reportedly controls over 60% of the dating app market across dozens of brands, faced downward pressure in the first quarter as the CEO stepped down in late January following a Q4 earnings miss. Between mid-January and mid-March, the security price dropped from $92 to $50 a share as lockdowns and other social distancing measures were implemented (see Figure 5). Analysts and consumers alike were skeptical of the prospects of dating apps during a global pandemic. Further, a GDPR data breach in early April did not help the case. Lending revenue spiked from April through July.

The end of March and the full second quarter showed much more promise for Match Group as government assistance programs and a Q1 earnings beat helped to steadily increase the security price to over $100 a share. Short activity followed, with average fees exceeding 1,000 bps leading to a dramatic revenue accumulation for the first half of 2020.

FIGURE 1. INO UTILIZATION (%)

FIGURE 2. INO PRICE PER SHARE (USD)

After a July spinoff from parent company Interactivecorp (IAC), the security has settled toward GC fees with utilization now under 10% amidst a recovery to pre-COVID levels of Match’s services.

Transportation companies are having to reinvent, and sometimes restructure, themselves to coax consumers out of their homes. As of now, it looks like it may be months or years before passengers and revenue return to pre-pandemic levels.

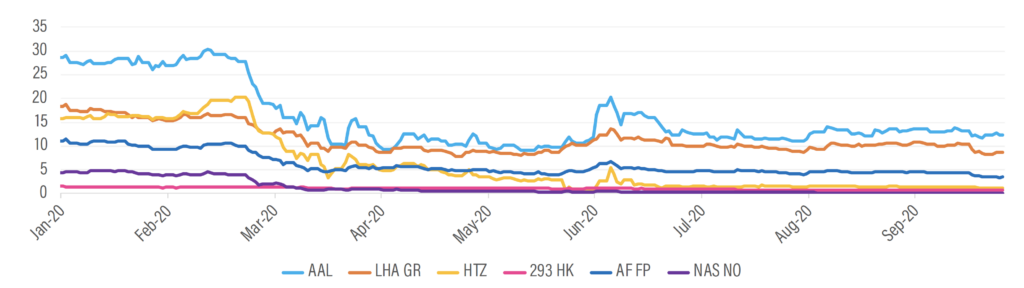

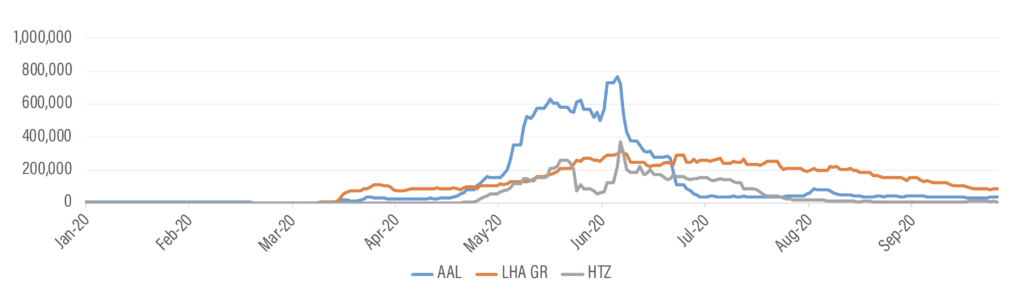

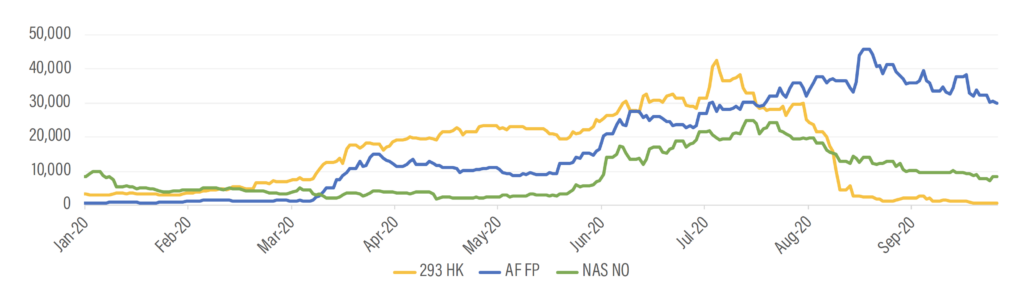

From most airlines trimming operations and furloughing staff, to full-blown bankruptcy in the case of Hertz, so-called BEACH companies (Booking, Entertainment & Live Events, Airlines, Cruises & Casinos, Hotels & Resorts) within this sector are some of the most negatively impacted. Looking at a few securities in this sector, including American Airlines (AAL), Lufthansa (LHA GR), Hertz (HTZ), Cathay Pacific (293 HK), Air France (AF FP) and Norwegian Air Shuttle (NAS NO), they all display similar trends in revenue and utilization with corresponding drops in security prices since the pandemic took hold. The two biggest securities lending earners so far this year are LHA GR and AAL, with $33.8 and $32.6 million in revenue, respectively.

Lufthansa, one of the top 5 equity earners in EMEA, was on the brink of bankruptcy in May as global lockdowns became commonplace. Even after a 9 billion euro bailout at the end of June, the airline was still heavily utilized at over 90% recently, although fees had retreated from their 1,500 bps high from early July. With Ryanair challenging the bailout of Lufthansa and lay-offs reported as recently as the end of September, the second-largest airline in Europe will be one to watch in the coming months as the pandemic continues to unfold.

American Airlines, reportedly considered one of the most at-risk U.S. airlines, entered COVID with higher-than-average debt levels. Although pre-COVID fees were at GC levels, the security already had a high utilization of over 50%, suggesting the U.S. airline was already under the microscope. Despite receiving government assistance, average fees quickly spiked to over 1,500 bps in May before tapering back to their warm levels today. However, with utilization remaining above 90%, there may be more to come with American Airlines. See Figures 6, 7 and 8 for more on the Transportation sector.

These are just a few of the securities highly impacted by the COVID pandemic. Stay tuned for future updates from DataLend as the world-wide recovery takes shape and plays out in the securities lending markets.

FIGURE 3. INO DAILY REVENUE (USD)

FIGURE 4. MTCH PRICE PER SHARE (USD)

FIGURE 5. MTCH DAILY REVENUE (USD)

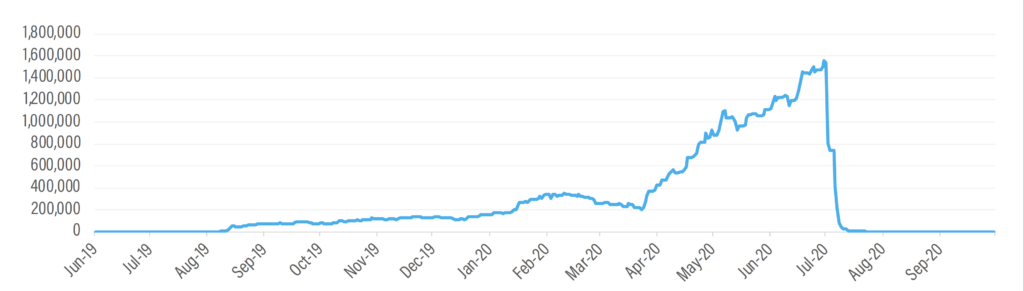

FIGURE 6. TRANSPORTATION SECTOR PRICE PER SHARE, Q1 - Q3 2020 (USD)

FIGURE 7. AMERICAN AIRLINES, LUFTHANSA & HERTZ DAILY LENDING REVENUE, Q1 - Q3 2020 (USD)

FIGURE 8. CATHAY PACIFIC, AIR FRANCE & NORWEGIAN AIR SHUTTLE DAILY LENDING REVENUE, Q1 - Q3 2020 (USD)

The data used in this article has been compiled using the DataLend Excel Add-In tool, which provides access to historical

data to subscribers instantly, right in Excel. Please contact us at sales@equilend.com to learn more.

About DataLend

DataLend is the securities finance market data division of EquiLend. DataLend tracks daily market movements and provides analytics across more than 52,000 unique securities in the $2.2 trillion securities finance market. www.datalend.com

Keith Min

DataLend Product Specialists

+1 (646) 767 4327

Keith.Min@equilend.com

David Poulton

DataLend Product Specialists

+44 207 426 4416

David.Poulton@equilend.com