LENDING ETFS

JAMES PALMER

Product Specialist, DataLend

September 26, 2017

The robust ETF lending market in the U.S. eclipses a nascent market in EMEA and Asia. DataLend examines the global ETF landscape

Exchange-traded funds (ETFs) have seen a marked increase in popularity and a rapid acceleration in asset growth in recent years. ETFs offer a low-cost alternative to actively managed mutual funds, which, in the current low-yield and cost-focused environment, has proven to be very attractive for investors. Yet their place in the securities lending market has not reflected this mass adoption.

“The ETF industry has continued to confound its critics, and it is therefore unsurprising that more and more issuers are coming to market, driving further asset growth,” says Andrew Jamieson, founder of Warriston Place Advisors, a specialist ETF and securities finance consultancy. “With this in mind, it is only a matter of time before it becomes a fully fledged component of the global securities finance industry.”

The lending of ETFs can significantly offset the cost of holding the product for beneficial owners while providing borrowers with a diversified index exposure in a convenient, single security wrapper. In August 2017, according to DataLend data, $38 billion of ETF assets were on loan globally, representing a utilization of 20% of all assets in the lendable pool. This represents a significant outperformance compared to common shares, which are 8% utilized on average, suggesting strong demand to borrow ETFs.

The top-five revenue-generating ETFs in the securities lending market in the first half of 2017 (see below) show some of the key drivers of borrower demand:

High-yield bond ETFs (HYG and JNK) provide an effective macro hedge for rising interest rates in the U.S.

ETFs that track emerging markets (EEM) allow borrowers to gain exposure to otherwise illiquid or inaccessible markets

Main index tracking ETFs (SPY and IWM) provide efficient and low-cost access to the index without the need to borrow each of the index constituents, reducing execution costs

Looking at the top earners also uncovers a regional disparity in the maturity of the ETF lending market, with 45 of the top 50 listed on U.S. exchanges. North American ETFs were significantly more utilized (23% versus 9%) and traded at lower fees to borrow (51 bps versus 127 bps) than the European equivalents in the first half of 2017. Asian ETFs have a higher 31% utilization rate than both European and North American ETFs, and they traded significantly higher at 197 bps on average. That trend suggests a less-developed lending market in the region more akin to the European market than North American one.

Digging deeper, DataLend examined the relative cost to borrow ETFs that represent an equity index versus the fees to borrow the underlying index members for the U.S. and the rest of the world. The fee to borrow the SPDR S&P 500 ETF (SPY), one of the most liquid securities across all product types, stood at a very low 13 bps in August 2017, matched by the similarly low weighted fee to borrow the underlying constituents of the S&P 500 of 18 bps. Conversely, the iShares FTSE 100 ETF (ISF) commands a fee of 127 bps to borrow versus a weighted average fee of just 24 bps to borrow the FTSE 100 index constituents. This highlights the disparity between the U.S. and European markets; in Europe, the main index-tracking ETF commands a premium over the index, while in the U.S. a similar main index-tracking ETF is actually priced at a discount.

Why is there such a disparity between the ETF lending market in the U.S. versus the rest of the world? Liquidity and perceived access to liquidity are central to the differences in the supply of ETFs within securities lending programs and to hedge fund demand. The U.S. lending market, with a single central securities depositary (CSD), currency, common tax and regulatory framework, affords a much more vanilla environment with a clear picture of ETF availability. Conversely, when looking at the European landscape, each of these factors has implications on the ability to source ETFs. Europe and Asia’s disparate regulatory landscapes and more punitive buy-in regimes also have forced ETF market-makers to borrow “at any rate” to prevent fines, driving up fees to borrow ETFs and creating unachievable benchmark rates. The infrastructure across jurisdictions, across CSDs and across exchanges inhibits the access to a centralized liquidity pool and the benefits of the fungible nature of the instrument. Efforts by industry-leading ETF issuers to drive a standardized settlement regime have helped matters, but the markets still do not match the simplicity of the U.S. ETF market. In an industry that is striving to increase automation with the help of tools such as EquiLend’s NGT, standardization is the key to an efficient market.

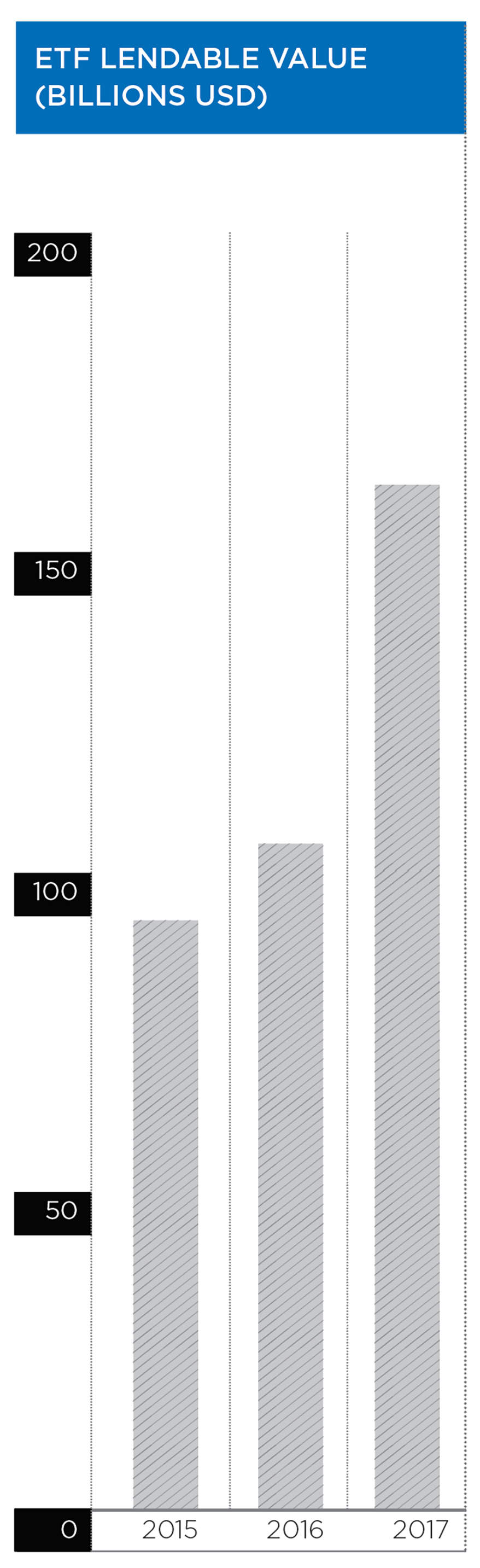

It is difficult, however, to attribute the growth of global ETF lending to a growing maturity of the ETF lending market and the participants using them, rather than merely the growth of the underlying assets. The lendable value of ETFs has increased significantly, with 50% year-on-year growth. DataLend’s Client Performance Reporting suite shows an approximate 21% increase in the number of underlying beneficial owner accounts showing ETFs in their inventory files this year versus 2016. This would suggest that the lendable base is both increasing in size and depth as more lenders enter the market.

The ETF lending market has grown considerably in recent years. However, various technological, educational and regulatory hurdles have stunted the growth of this component of the securities lending market. Further regulatory improvements for the treatment of ETFs in terms of capital treatment and funding combined with greater flexibility around the acceptance of ETFs as collateral will act to improve liquidity and promote the product. Given the sizeable global increases in AuM, the revenue potential from ETFs in the securities finance industry has become too big to ignore.