Survey: Beneficial Owners on Data

October 2019

By Tom Ashton, Product Specialist, DataLend

Funds Europe found in its recent survey of beneficial owners that these institutions view securities lending as an investment product and should in turn use independent securities lending data to optimize their programs, mitigate risk and support them in their fiduciary responsibilities.

SECURITIES LENDING is increasingly viewed by beneficial owners as an alpha-generating investment product—and many are utilizing securities lending data and analytics to sharpen the performance of their lending strategies and to integrate with their portfolio decision making. However, there is still a sizeable group of beneficial owners—defined as asset managers, insurance companies, sovereign wealth funds, pension funds and other asset owners that engage in securities lending—that may be failing to extract full value from their lending programs because they do not have access to market data.

These are key conclusions emerging from the DataLend Portfolio Beneficial Owner Survey 2019 conducted in partnership with Funds Europe.

During 2018, securities lending generated almost $10 billion in revenue for the asset owner community. This is motivating lenders to develop a deeper understanding of how their lending parameters are delivering performance against their industry peers—and at what level of risk. While previously assumed to be of interest primarily to asset servicing teams, lending data is now being used to feed portfolio construction and to track investment opportunities in the market.

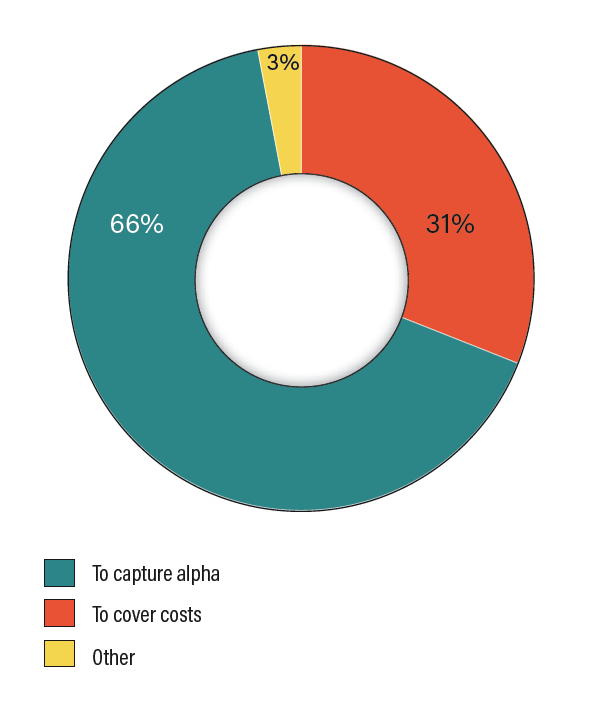

Indeed, 66% of beneficial owners participating in the survey said that their primary motivation for engaging in securities lending was to generate alpha, a 7% increase on the response from the previous Beneficial Owner Survey conducted in December 2017. Commenting on these results, Nancy Allen, Global Product Owner at DataLend, says that many beneficial owners are no longer content simply to receive a summary report at the month end detailing how much the portfolio generated through lending activity.

What is your firm’s primary objective for participating in securities lending?

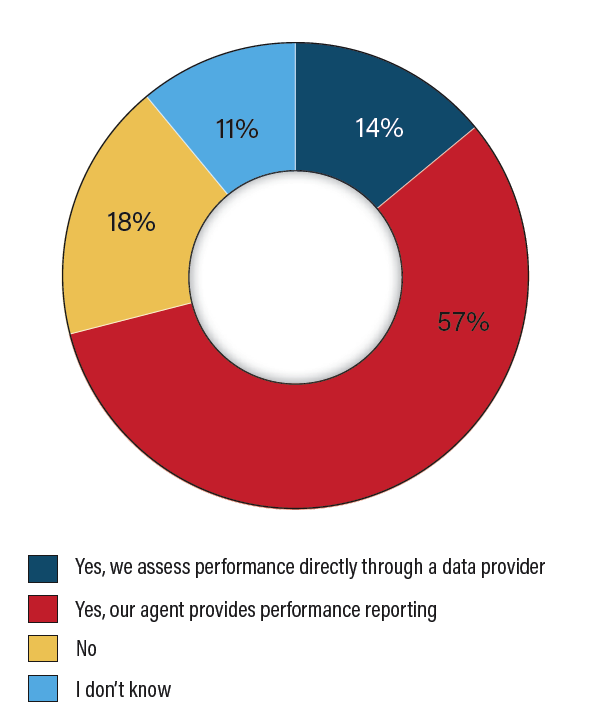

Does your firm monitor securities lending performance relative to the broader market?

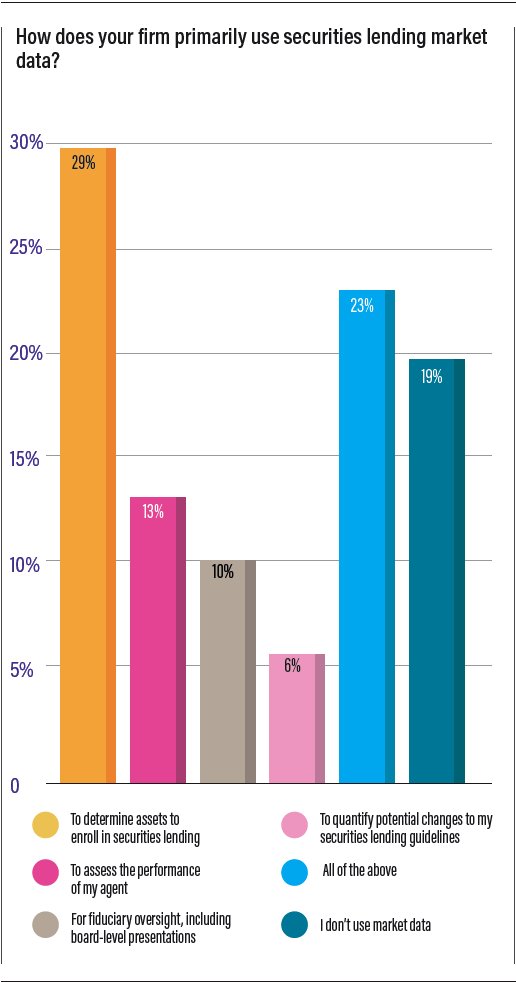

“Rather, beneficial owners are demanding more detailed data and analytics to drive their decision making. They are using data to determine which assets to enroll in their lending program, to monitor returns on those assets, to monitor loan demand across specific counterparties and to determine if they should revise collateral eligibility criteria. With the right data, beneficial owners can assess their current lending guidelines and decide whether they wish to tighten or relax those parameters to target a different expected return.”

Although many asset owners currently receive securities lending market data from their agent lender, the survey reveals that 13% of respondents currently source independent securities lending data from a market data service such as DataLend and a further 9% source this from an independent consultant. However, it is noteworthy that approximately one-fifth of respondents said they do not have access to securities lending market data.

“This result indicates that a sizeable group of beneficial owners are leaving value on the table by failing to apply market data and analytics to guide their lending strategies,” says Allen. “By utilizing tools such as DataLend Portfolio, we can demonstrate to beneficial owners that they may be losing out on value by restricting certain securities—and predict how much additional revenue will be generated by including these assets in their lending programs.”

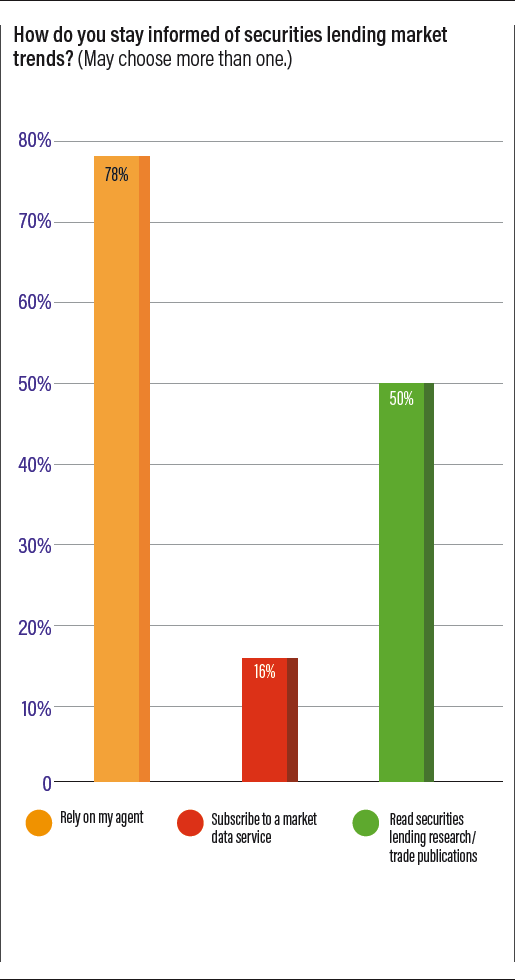

The survey also highlights the importance of independent research reports and publications in enabling asset owners to stay informed about current trends in securities lending markets. More than 50% said that they use independent research and trade publications, such as DataLend’s quarterly securities lending publication The Purple, to stay informed about developments in the market—often using this in parallel with market information they receive from agent lenders.

“This reflects the way that beneficial owners are now thinking about their lending activity,” says Allen. “We have seen a strong rise in demand for DataLend Portfolio over the past two years, enabling beneficial owners to apply independent evaluation of performance across their loan portfolios – and to compare across standardized peer groups (based on type of legal entity, location and collateral type for example) to ensure like-for-like comparison regardless of which agent lender they may be using.”

To strengthen fiduciary oversight, beneficial owners are also inviting consultants to give board-level presentations, providing detailed analysis of the risks, the key drivers of performance and the compliance responsibilities associated with their lending programs.

As appetite for independent securities finance data continues to grow, the key is to offer flexibility in service delivery while minimizing operational complexity this may present to the client. Many beneficial owners—whether managing securities lending in-house, or through single or multiple agent lenders—wish to receive consolidated reporting across their lending program, accessible via a single login.

While many clients prefer to access data via a Web-based user interface, others may choose to receive a raw data file, to use an Excel add-in tool or to pull data directly from the data provider via an application programmable interface (API).

For DataLend, the future is to work closely with beneficial owners—and with lending agents—as they apply data to drive decision-making within their securities lending programs. Looking ahead, Allen predicts a rise in the application of artificial intelligence and machine learning, allowing users to apply predictive analytics to their lending strategies. “We recognized that securities finance data can unlock untapped value in securities lending markets, and we are working with beneficial owners and with lending agents to extend these advances to a wider community of users,” says Allen.