DataLend API

DataLend API

Advanced Analytics & API for Securities Finance

Business intelligence and data analytics tools are increasingly crucial for securities finance market participants. DataLend’s robust and award-winning securities finance market data allows firms to make the most informed trading decisions with its comprehensive, global data set and powerful analytical tools. The DataLend API offers direct access to DataLend’s database in a fast, flexible and developer-friendly solution ready to be tailored for a firm’s proprietary system.

Advantages

Instant access to the DataLend ecosystem

Simplified integration to your business intelligence tools

No expensive or time-consuming storage and ETL process to maintain

Amendments to data are automatically reflected

New data fields are easily implemented

Historical data

Notes to Developers

Up-to-date RESTful API architecture implemented on scalable, cloud-based technologies

Built with HTTP Web standards for direct compatibility with open-source libraries in many software languages

Sub-second response times, ensuring a consistent and swift experience

Well-formed concrete nouns for the securities lending industry and standard HTTP verbs for the request

All queries are executed over HTTPS, ensuring secure communication

Authentication and authorization based on latest OAuth 2.0 standards

Best Market Data Provider Globally

Global Investor/ISF Awards 2013, 2014, 2015, 2016,

2017, 2018, 2019, 2020, 2021, 2022

Trading Analytics by DataLend

Trading Analytics

Powered by DataLend

NGT Trading Analytics: Insights Made Simple

Trading Analytics offers unparalleled insight into your NGT trading activity through an intuitive, simple-to-use Web portal. Easily access and analyze trade activity across your counterparties and your rank amongst all firms on NGT.

Best Market Data Provider Globally

Global Investor/ISF Awards 2013, 2014, 2015, 2016,

2017, 2018, 2019, 2020, 2021, 2022

DataLend Consulting

DataLend Consulting

DataLend Reporting Packages: Flexible Market Insights

In an effort to provide more focused and flexible support for our clients, DataLend is now offering reporting packages to complement our existing suite of analytical tools (Web-based interface, daily FTP files, Excel Add-In and API). The below packages provide clients with the flexibility to access a standard suite of market reports along with the opportunity to design bespoke analyses.

Key Benefits Include

Day-to-day support and one-off data queries

Regular market analyses

Tailored reports and reporting packages

Market rankings and wallet share

Best Market Data Provider Globally

Global Investor/ISF Awards 2013, 2014, 2015, 2016,

2017, 2018, 2019, 2020, 2021, 2022

DataLend Portfolio

DataLend Portfolio

DataLend: Global Securities Finance Data

DataLend provides aggregated, anonymized, cleansed and standardized securities finance data covering all asset classes, regions and markets globally.

For Beneficial Owners

Review all your securities lending data in one place with the new DataLend Portfolio. Whether you have a single- or multi-agent securities lending program, your single login to DataLend Portfolio will provide you with an aggregated view of your securities lending activity. Drill down into each program to access DataLend’s standardized performance metrics, used by agent lenders around the globe.

Aggregated View

Asset allocation

On loan

Utilization

Fee

Revenue

Return to lendable

Performance Measurement

Drill down into each agent lender program to analyze performance at a program level. DataLend Portfolio features:

Standardized Peer Groups

Ensure consistency across performance reviews through the use of DataLend’s standardized peer groups. DataLend’s peer groups are controlled by the DataLend proprietary algorithm. Choose from peer groups based on fiscal location, legal entity and/or collateral type.

Exclusive Data

DataLend has access to inventory and loan positions not included in any other securities lending data service. Ensure this data is part of your analysis to obtain the most accurate performance measurement possible.

Flexibility

ACCOUNT DRILLDOWN

- Identify which accounts are under or over-performing versus the group.

- Navigate to a selected account for further analysis.

CREATE-YOUR-OWN PERFORMANCE METRICS

- Multi-select by asset class, country and sector over a customized time period and tailored account groups.

Client Confidentiality

DataLend maintains the highest data security standards to protect client data and identity:

- EquiLend: DataLend is affiliated with EquiLend LLC, which is regulated by the SEC.

- Internet Protocol (IP) Security: All User IDs are tied to an approved organization IP address meaning a user cannot log-in from outside their corporate network.

- Segregation: Each client organization within DataLend is strictly segregated from other organization in our secure database tables. User IDs are tied directly to an organization.

Check Out "The Purple", A DataLend Research Publication

Agent Lender Performance Metrics

Agent Lender Summary Statistics

Best Market Data Provider Globally

Global Investor/ISF Awards 2013, 2014, 2015, 2016,

2017, 2018, 2019, 2020, 2021, 2022

Client Performance Reporting

DataLend Client Performance Reporting

Experience robust performance reports with unparalleled insight into your securities lending program. Benefit from standardized performance measurement, flexible but DataLend-controlled peer groups and unique and exclusive data. Optimize your lending program and maximize revenue by making the most informed decisions with DataLend’s CPR.

Standardized Peer Groups

Ensure consistency across performance reviews through the use of DataLend’s standardized peer groups. DataLend’s peer groups are controlled by the DataLend proprietary algorithm. They cannot be manipulated to impact performance.

Four peer group matching options allow users to select the best peer group match (in addition to matching at the security and dividend rate by default):

Industry (most relaxed criteria)

Legal structure and collateral type

Legal structure and fiscal location

Legal structure, fiscal location and collateral type (strictest criteria)

New! DataLend Collateral Matching

Exclusive Data

DataLend has access to inventory and loan positions not included in any other securities lending data service. Ensure this data is part of your analysis to obtain the most accurate performance measurement possible.

Flexibility

ACCOUNT DRILLDOWN

REVIEW PERFORMANCE ACROSS ALL ACCOUNTS

- Identify Which Accounts Are Under Or Over-Performing Versus The Group

- Navigate To A Selected Account For Further Analysis

CREATE-YOUR-OWN PERFORMANCE METRICS

Multi-select by asset class, country and sector over a customized time period and tailored account groups.

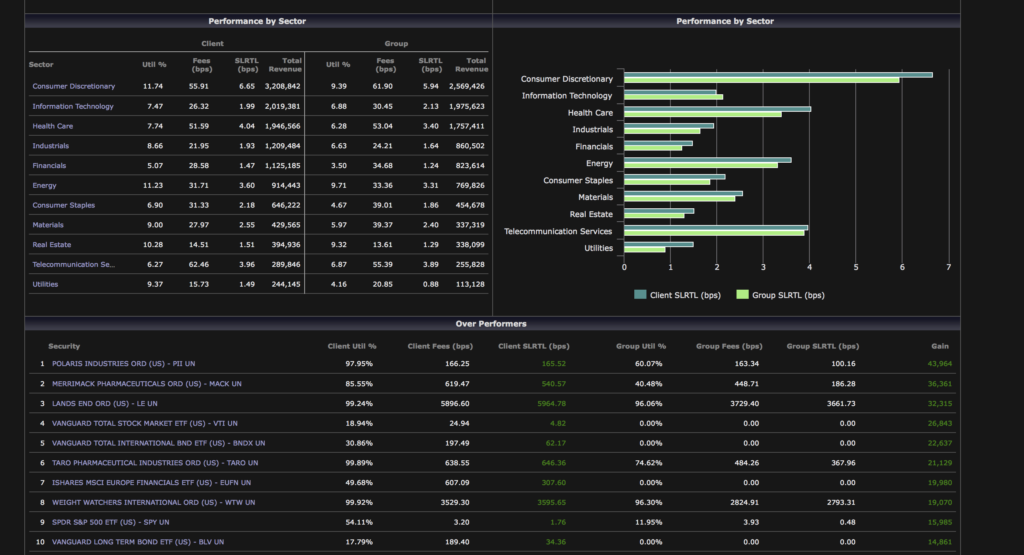

Portfolio Summary

Use the filter options to choose your peer group, timeframe and asset class to see how your portfolio is performing on a relative basis.

Performance Metrics

Once your filters are applied, a wide variety of performance metrics will appear. Examples include performance by sector and over performers, pictured here

Best Market Data Provider Globally

Global Investor/ISF Awards 2013, 2014, 2015, 2016,

2017, 2018, 2019, 2020, 2021, 2022

DataLend

DataLend

Global Securities

Finance Data

DataLend provides aggregated, anonymized, cleansed and standardized securities finance data covering all asset classes, regions and markets globally.

DataLend Advantage

Data available T+1

Rigorous data cleansing process

Leverages EquiLend & BondLend trading data

Proprietary indices, including DataLend Target 50 and DataLend Newly Hot

Options-derived implied borrow cost

Daily newsletters and automated reports

Frequent thought leadership contributor to RMA, ISLA, PASLA, CASLA, IMN and other securities lending associations as well as various industry magazines

As of January 2026

Best Market Data Provider Globally

DataLend Offers Four Ways to Access:

Raw data files that contain fees, utilization and other metrics across all securities on loan

An intuitive and highly customizable Web-based user interface

An Excel Add-In tool that supports functions and right-click functionality

An Application Protocol Interface (API) that allows clients to access data directly from the database

Client Confidentiality

DATALEND MAINTAINS THE HIGHEST DATA SECURITY STANDARDS TO PROTECT CLIENT DATA AND IDENTITY:

Internet Protocol (IP) Security: All User IDs are tied to an approved organization IP address meaning a user cannot log-in from outside their corporate network.

Beneficial Owner Confidentiality: Each agent lender assigns a code to their underlying beneficial owner client. DataLend does not know the identity of any beneficial owner.

Segregation: Each client organization within DataLend is strictly segregated from other organization in our secure database tables. User IDs are tied directly to an organization.

Introducing EquiLend Spire

Trading

- All

- Trading

- CPR

- Research

Trading

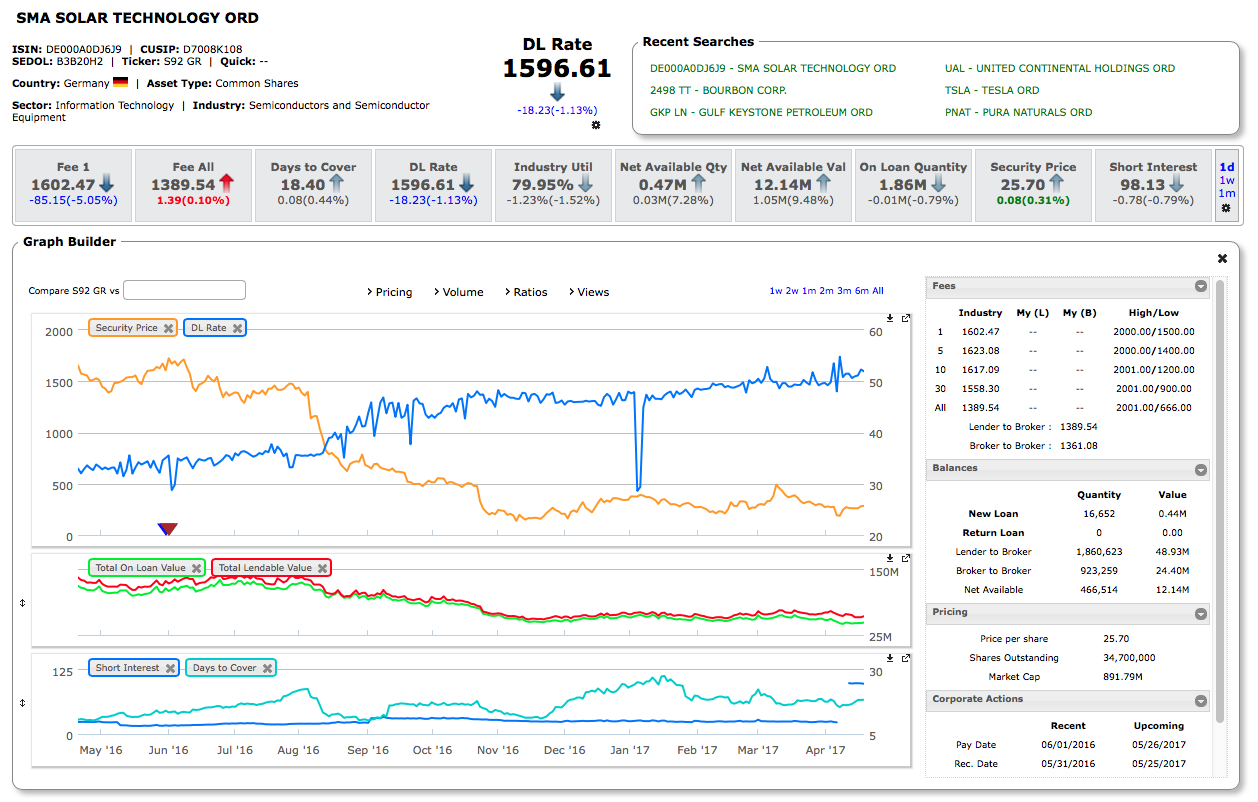

The Security Search screen is a highly customizable, intuitive view into securities lending activity taking place within a specific security. The tool contains current and historical data, including volume-weighted average fees, utilization, on-loan and inventory balances, short interest, re-rate information, transaction-level data, corporate actions and other information critical to securities lending trading performance.

CPR

The Security Search screen is a highly customizable, intuitive view into securities lending activity taking place within a specific security. The tool contains current and historical data, including volume-weighted average fees, utilization, on-loan and inventory balances, short interest, re-rate information, transaction-level data, corporate actions and other information critical to securities lending trading performance.

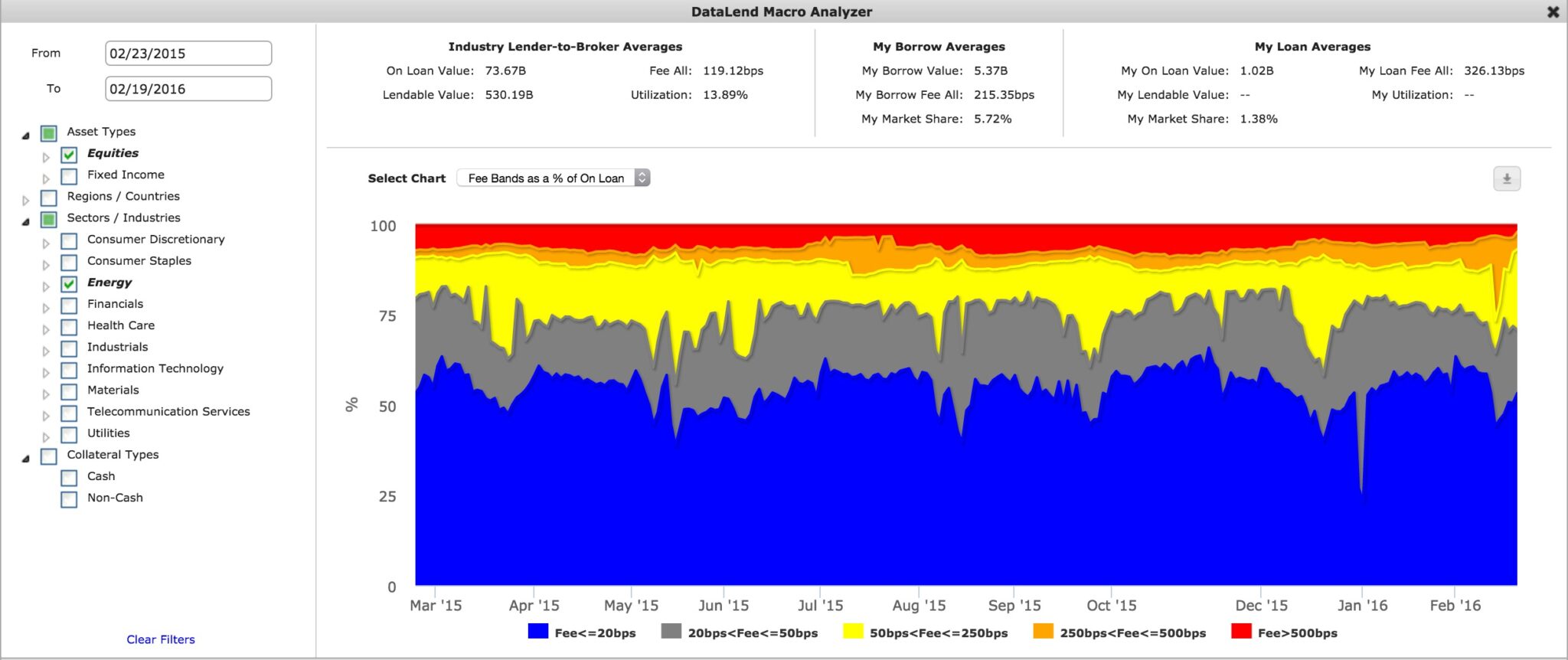

Research

The Research screens allow traders and analysts to assess their portfolio performance relative to the industry either at an aggregate level or drilled down to the asset class, sector or individual security level. The screens also allow users to identify market movers with predetermined fee or utilization changes. Reports may be customized and emailed on a daily, weekly or monthly basis.

Best Market Data Provider Globally

Global Investor/ISF Awards 2013, 2014, 2015, 2016,

2017, 2018, 2019, 2020, 2021, 2022