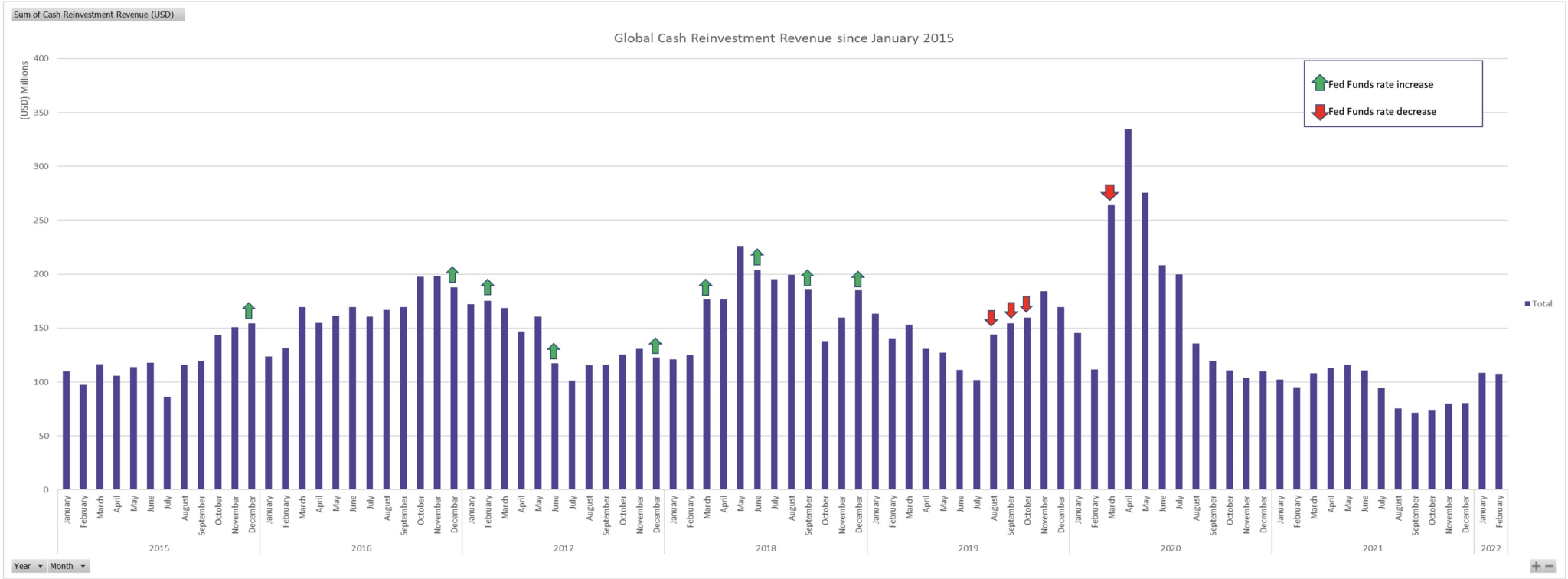

DataLend: February 2023 Securities Lending Revenue Up 34% YoY to $850 Million

The global securities finance industry generated $850 million in revenue for lenders in February 2023, according to DataLend, the market data service of fintech EquiLend. The figure represents a 34% increase from the $634 million generated in February 2022.