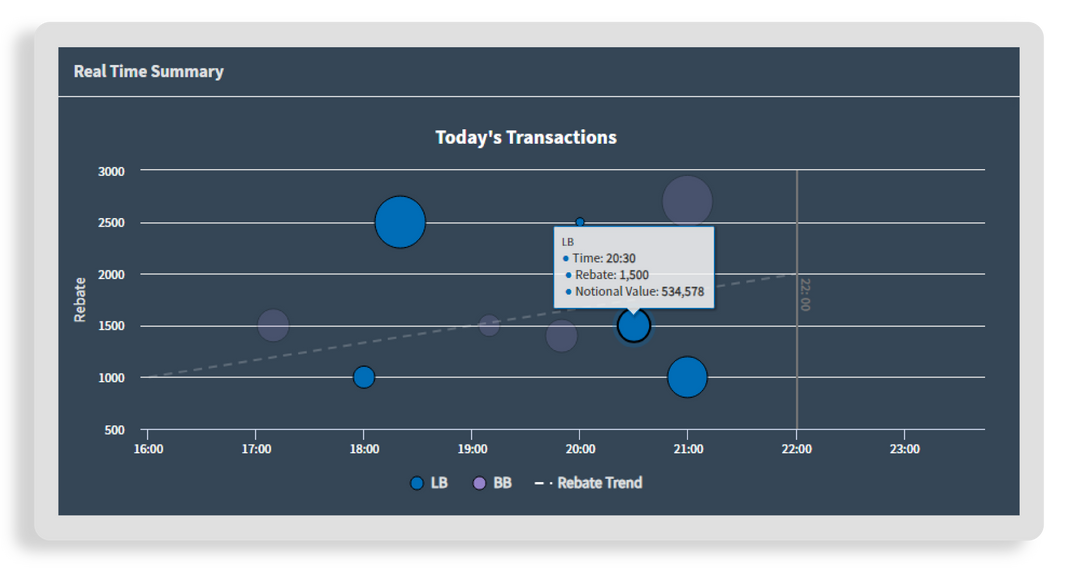

APAC 2024 Performance

While global securities lending revenue faced headwinds in 2024, the Asia-Pacific (APAC) region showed resilience, experiencing a comparatively modest 1.8% year-over-year (YoY) decline to $2.1 billion. The majority of revenue was generated by equities, contributing $2 billion, representing a 0.3% YoY decline. A 3.3% increase in fees was offset by a 3.8% decrease in on-loan balances.