In Fintech, An Inflection Point

A technology provider such as EquiLend is ideally placed to incorporate revolutionary technologies into services already used by firms throughout the industry.

January 2025

A technology provider such as EquiLend is ideally placed to incorporate revolutionary technologies into services already used by firms throughout the industry.

Australia: Down Under in Securities Finance Robert Antelmann, Product Specialist, DataLend September 19, 2018 THE AUSTRALIAN EQUITIES market was placed third in Asia Pacific by market size behind Japan and Hong Kong, respectively, in 2017. The equities securities lending market in Australia is characterized by a decentralized network of bilateral relationships consisting of both onshore

DataLend investigates the bond markets of the U.S., Latin America and Europe amidst a backdrop of trade wars and rising interest rates.

A Q&A with David Field, Founder and Managing Director, The Field Effect

Accesing China Chris Benedict, Director, DataLend April 11, 2018 Investors have been clamoring for access to China’s capital markets for decades. With China having overtaken the U.S. as the world’s largest economy last year (although the U.S. is still top in terms of gross domestic product, at $18.6 trillion), investors’ desire for exposure to mainland

Some firms are reinventing themselves, apparently capitalizing on the market’s fervent enthusiasm for all things blockchain. The securities lending market appears to be skeptical.

A Q&A with Craig Donohue, Executive Chairman & Chief Executive Officer, OCC

Bitcoin’s spectacular rise in value relative to government-issued centralized currencies has dominated headlines in the past year.

REGIONAL FOCUS: ASIA PACIFIC ROBERT ANTELMANN Product Specialist, DataLend September 26, 2017 Securities finance revenue in Asia ex-Japan for the first half of 2017 fell when compared to the same period in 2016. Overall revenue for the region was down by 17% year over year, from $615.4 million in 2016 to $508.5 million this year.

REGIONAL FOCUS: EMEA JAMES PALMER Product Specialist, DataLend NIMISHA PATEL Product Specialist, DataLend DAVID POULTON Product Specialist, DataLend The EMEA region saw a decrease in overall securities lending revenue in the first half of 2017 compared to the same period in 2016, which was in line with global trends in the industry. While a year-over-year

REGIONAL FOCUS: AMERICAS BY CHRIS BENEDICT Director, DataLend MATT ROSS Product Specialist, DataLend KEITH MIN Product Specialist, DataLend On-loan and inventory balances for North and South America grew in the first half of 2017, buoyed by continued strong performance in the cash markets. The average lendable inventory of $10.38 trillion and average on-loan balance of

The robust ETF lending market in the U.S. eclipses a nascent market in EMEA and Asia. DataLend examines the global ETF landscape

While the securities finance industry has become considerably more transparent than it was a decade ago with the advent of specialized data providers such as DataLend, the critical metrics that market participants monitor on a daily basis are still relatively unknown outside the institutional marketplace.

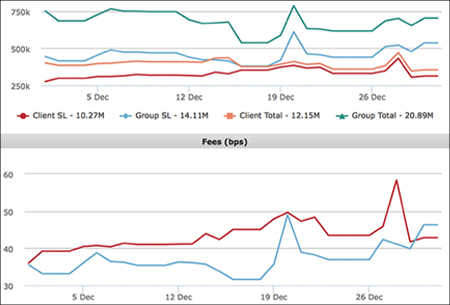

For all parties involved in securities lending, transparency has become increasingly important to ensure that optimal value is extracted from lending programs.