Securities Lending 101: Understanding Market Metrics

Discover stock utilization & other key securities lending metrics with DataLend’s comprehensive guide, revealing market trends in securities finance & cash markets.

Discover stock utilization & other key securities lending metrics with DataLend’s comprehensive guide, revealing market trends in securities finance & cash markets.

DataLend highlights the latest trends in securities finance in the South Africa region.

We reviewed the impact of the short-selling bans in Europe and Asia and compared the quarterly and yearly revenue year over year.

Throughout the COVID pandemic, a number of industries have been roiled, from pharma, which is working to develop a vaccine, to transportation, which flatlined as the world went into lockdown.

Funds Europe found in its recent survey of beneficial owners that these institutions view securities lending as an investment product and should in turn use independent securities lending data to optimize their programs, mitigate risk and support them in their fiduciary responsibilities.

There has been substantial media coverage regarding the ongoing opioid crisis sweeping through America, from which headlines have begun to spill over into the financial world.

Women in Securities Finance is an independent industry women’s group formed at the beginning of 2018 to foster connections in the securities finance industry.

On the surface, DataLend may seem like a fairly straightforward product: The system takes in some data from users and returns some data to users. However, when you look under the hood you quickly realize that processing and distributing this data is no easy task.

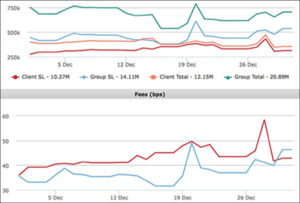

To provide our clients with the most robust analytics available, EquiLend brought together DataLend’s powerful data processing and visualization know-how with NGT’s dataset to bring you The Pulse—Precision Analytics Powered by DataLend.

As the financial crisis roiled the global markets in 2008, the business models of these dealers were about to fundamentally change.

With the ever-increasing velocity at which data is being created, zetta (1 billion terabytes), yotta (1,000 zettabytes) and brontobytes (1,000 yottabytes) will soon become the language with which we describe data volume.

A technology provider such as EquiLend is ideally placed to incorporate revolutionary technologies into services already used by firms throughout the industry.

Some firms are reinventing themselves, apparently capitalizing on the market’s fervent enthusiasm for all things blockchain. The securities lending market appears to be skeptical.

Bitcoin’s spectacular rise in value relative to government-issued centralized currencies has dominated headlines in the past year.

For all parties involved in securities lending, transparency has become increasingly important to ensure that optimal value is extracted from lending programs.

Consultants specializing in working with firms to optimize their lending programs discuss how their beneficial owner clients are making the most of securities finance market data.

While SFTR presents challenges for lenders, the regulation also raises an opportunity to reform, and streamline, global trading models.